With No Cash Value – Is Term Insurance a Waste of Money?

As a self-employed real estate agent or broker, your life insurance is an important responsibility, and as such, you certainly want to make certain you’re getting your money’s worth and that you’ve purchased the insurance solution that best meets your needs, but is term a waste of money?

Understanding that there are many insurers that offer policies in all shapes and sizes, it’s certainly understandable that you’d have many questions about the different products available. If you have discussed life insurance with a friend or neighbor, or have done some online research, you’re likely to have ended up with more questions than the answers.

Life insurance is a product that fulfills a financial need in an affordable manner. Since individuals and families have different financial needs, there are different insurance products that will provide solutions. Having said that, the answer to the question “with no cash value – is term insurance a waste of money”, the answer is “it depends on why you purchased it.”

If you Purchased Term Insurance to Cover Debt

Term insurance is very affordable life insurance that is purchased for a period of time or a term.

The following examples can help you determine if term insurance would be a waste of money:

- Purchased to pay off debt or a mortgage:

Fred Wilson recently purchased a home by taking out a $600,000 mortgage. Since Fred was concerned that his wife would be unable to meet the mortgage requirements if he were to die unexpectedly, Fred purchased $600,000 in term life insurance for a 30 –year term. Since Fred is in good health, his insurance premium was $45 per month.

After 16 months, Fred is involved in a car accident and succumbs to his injuries and dies.

As the beneficiary, Fred’s wife receives a check from the insurer for $600,000 and immediately pays off the mortgage on the home. Was the term insurance Fred invested $45 per month or $720 in worth it? Absolutely!

Now let’s consider an alternative scenario.

If you Purchased Term for Life Insurance

Since term insurance is temporary insurance, it’s the last policy you should consider if you are looking for insurance that will be there to pay for final expenses, replace your income, or leave a legacy. The reason term insurance is so inexpensive is that most policyholders outlive the term, convert the policy to permanent insurance, or simply cancel it when the debts they are insuring against have been paid. As far as life insurance products, term insurance has the lowest mortality rate.

What’s The Better Alternative?

Cash value insurance is always a better alternative than term. Simply put, owning is better than renting. When you purchase cash value insurance such as Whole Life or Universal Life, you insurance becomes more of an investment than an expense. As your cash value accumulates and earns tax-free interest, your policy becomes an asset rather than a liability.

The most popular type of permanent insurance in the marketplace today is Universal Life

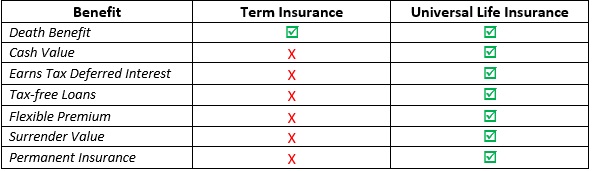

(standard and variable) because of its flexibility and various living benefits. The difference between Term and Universal Life is very apparent when you consider their benefits:

What About Whole Life?

Whole life is considered permanent life insurance and offers a guaranteed death benefit and a guaranteed periodic premium. The policy is a contract between the insurance company and the insured that states that as long as the contract items are met (premiums paid), the insurance company will pay the death benefit to the beneficiaries list on the policy.

Since the mortality rate for whole life policyholders is higher than other types of life insurance, and the death benefit and periodic premiums are guaranteed, the premiums for whole life insurance are much higher than term insurance.

The policy does provide a cash value account that earns interest at a rate guaranteed by the insurer. Most insurers allow for the policy owner to take loans against the cash value for any reason and without proof of a worthy credit history. Today, whole life is used to fund final expense plans since the insurance can be purchased in lower face amounts and the companies will typically issue policies for people up to 80 or 85-years old.

Why Universal Life Works Better

Universal Life insurance contains the living benefits and flexibility that allow it to be a financial solution for many different situations. Although the premiums are somewhat higher than term insurance, the additional money purchases a permanent policy that can be designed to meet more than one specific need.

The insured can design the death benefit to meet many of the financial needs of their surviving loved ones. Issues like final expenses, monthly living expenses, outstanding debts, mortgage payoff, and tuition expenses can be funded very affordably using a Universal Life product.

As your cash value account grows through tax-deferred interest, the policyholder can easily take loans against the policy on a tax-free basis for any reason, In fact, policy loans are not required to be repaid. Any outstanding loans will be deducted from the death benefit when a death claim is filed by the beneficiary.

Policyholders are also able to access accumulated cash by a partial or complete surrender of the policy. The money in the cash value account belongs to the policyholder, not the insurance company.

A Universal Life product is the only type of life insurance that allows for a flexible premium or death benefit. For example, if you need to skip a monthly premium, your policy will remain in force as long as there are sufficient funds in the cash value account to cover the monthly premium. You can also reduce the death benefit and the periodic premium if you find you need less insurance due to life changes.

Many financial planners use a Universal Life product to design a tax-free income stream to supplement other retirement benefits. This is done by using the tax-free loan options in such a way that the cash value account is turned into an income stream.

Overall, before you consider purchasing life insurance, get professional advice from an experienced and reputable broker. Your broker will ask the needed discovery questions that will reveal your individual needs and the needs of your family, and then design a policy that will provide the needed solutions for your individual situation.